In brief: Tech companies continue to pour billions of dollars into artificial intelligence-related areas, from hardware and software to general investments and acquisitions. But reaping the financial rewards is taking longer than expected. Meta's announcement that it is spending more on AI while profitability remains a long way off has spooked investors, and other companies are feeling the same pressure.

Meta said that it would be spending billions of dollars more on its AI efforts, raising expenditure forecasts in this area from $30 - 37 billion to $34 - 40 billion for the year. It cited heavy investment in AI infrastructure such as data centers, chip designs, and research and development for the increase. Meta also predicted that revenue for the current quarter would be lower than expected.

During an earnings call with investors, Meta CEO Mark Zuckerberg said that profitability from generative AI will take years, but asked for patience. "Smart investors see that the product is scaling and that there is a clear monetizable opportunity there even before the revenue materializes," he said. Zuckerberg also pointed to the energy costs of generative AI for Meta's higher spending.

Zuckerberg has experience when it comes to assuring investors that new tech costing the company a fortune will eventually pay off. Meta's Reality Labs, the VR/AR business responsible for its metaverse ambitions, has hemorrhaged more than $42 billion since the end of 2020, but Zuckerberg continues to insist that the metaverse will make billions or even trillions of dollars after 2030.

Meta's not the only one spending more on AI. New Street Research analysts predict Google parent Alphabet will see its full-year capital expenses increase to about $45.9 billion, up from previous estimates of $42.7 billion, partly as a result on spending in this field, writes Reuters.

Microsoft has also spent billions in this area, including the more than $10 billion investing in OpenAI. Like Alphabet, Microsoft said earlier this year that it expects its AI-related costs to keep rising.

Despite Meta's income growing 27% YoY in the first quarter to $36.5 billion, beating Wall Street's predictions, and profit more than doubling to $12.4 billion, the high spending and lower-than-expected revenue for the current quarter saw the company's stock crash 16%. Microsoft is down 2%, Alphabet fell 3%, and Nvidia was down 1.4% as a result.

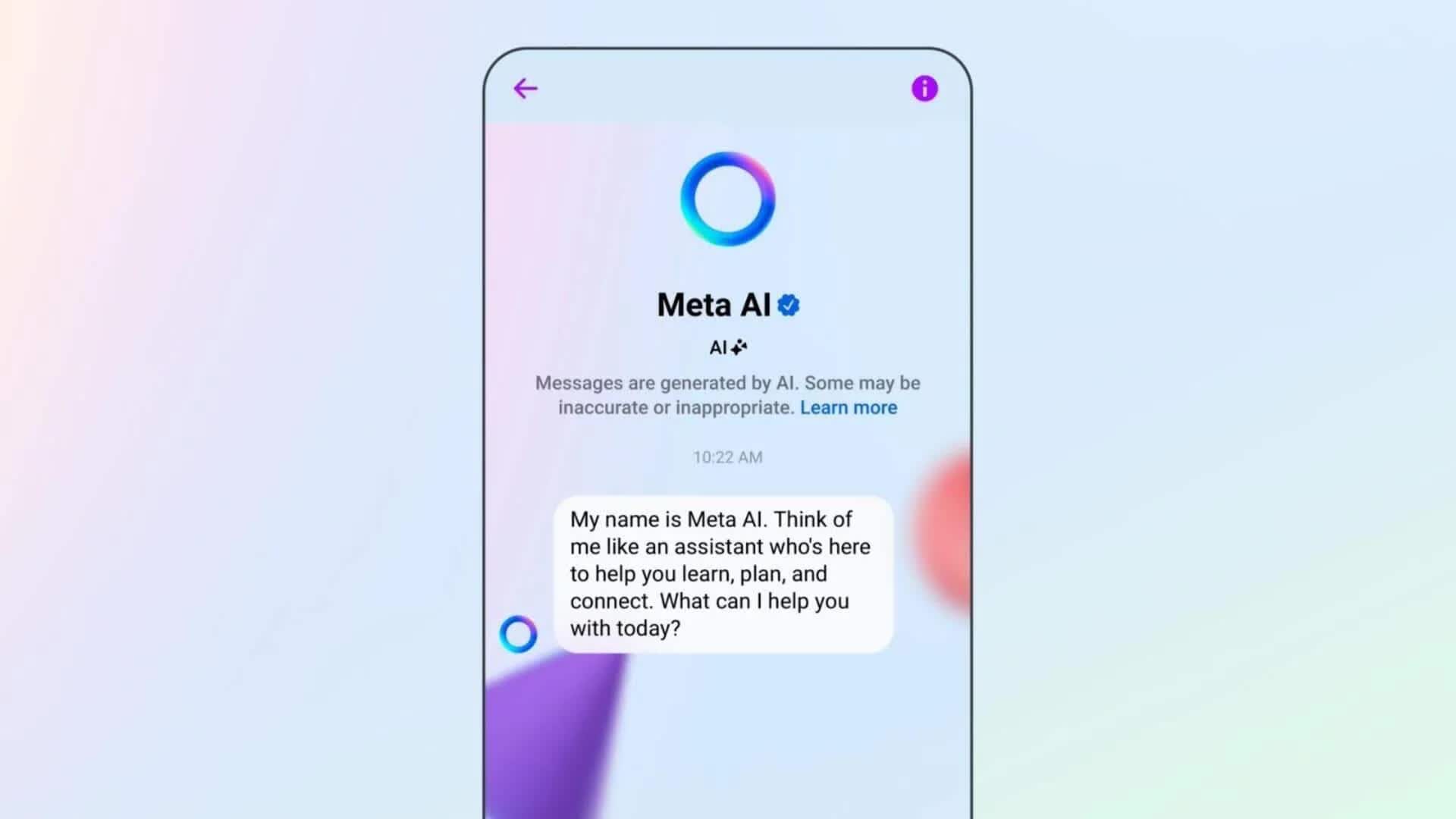

Meta AI assistant was pushed out across the company's suite of apps last week. It's currently free to use, but Meta believes there are plenty of ways to monetize the feature, such as enabling people to pay to use bigger AI models and access more compute. Zuckerberg also believes AI will improve app engagement, leading to more ad money. Whether that will calm nervous investors looking for near-term gains remains to be seen.