Welcome back to another month of looking at how expensive graphics cards are at retail at the moment. Unfortunately, after a brief glimpse of hope a few months back, MSRP GPUs are off the table this year based on the trends we're seeing. Many of you have already accepted that would be the case a while ago, but we're still tracking GPUs closely and so we're back for another monthly instalment.

Updated: See our latest GPU Pricing Update here.

One of the major happenings this month was the launch of the AMD Radeon RX 6600, a fairly average product that's both bad value and good value at the same time. Bad value from the sense that it performs quite closely to the last-generation RX 5600 XT despite costing 20% more, but good value from the sense that in the current market, actual retail prices make it one of the better GPUs going around if you look at cost per frame.

In a surprise to exactly zero people, AMD's advertised MSRP of $330 turned out not to be true for the vast majority of buyers. The card was apparently available for $330 for a limited run of cards at launch, but since then prices have increased across the board. This is the same pricing strategy we saw with the 6600 XT's launch, where the MSRP was not representative of the card's price in the days and weeks afterwards. This sort of highly misleading MSRPs are just par for the course these days, not that we think they are acceptable.

What we've heard from retailers surrounding the Radeon 6600's launch is that the card was available in good quantities, but the majority of this stock was being sold via distributors and AIBs at a much higher price than the listed MSRP. One retailer we spoke to suggested that the RX 6600 was being bought up by miners at the lowest available prices, based on the buying patterns and distributor availability they were seeing, leaving the more expensive offerings on shelves for the gaming crowd.

In markets outside the United States, the card is typically available to purchase right now at prices well above MSRP. In Australia, the cheapest cards at PC Case Gear start at $700 AUD, while over in Europe at Mindfactory you're faced with prices starting at 509 euros. In both cases, this is a ~50% hike over MSRP, and the card is clearly gathering little interest at that sort of inflation as they're still available over a week after launch.

Meanwhile, the closest competing card, the GeForce RTX 3060 from Nvidia, is priced significantly higher. In Australia, you're looking at a 71% increase in price going from an RX 6600 to RTX 3060 for an 11% performance improvement in our 1440p testing.

The hike is less insane in Germany where the RTX 3060 is some 28% more expensive than 6600s, but it's still relatively favorable for AMD at retail right now. But clearly not favorable enough as plenty of AMD GPUs are sitting unsold.

And this continues the basic trend we've seen for months at retail. Outside of the United States, most regions have plentiful stock of current generation GPUs, but pricing remains highly inflated. Our understanding is this is entirely due to distributors and AIBs, who are hoping to use high prices to cash in while mining is still profitable, even though GPUs are not really selling that well at retail at these sorts of prices. In fact, there's been a slight upward trend in pricing over the past few months at retail to further put the screws in.

Because this has been the case for a few months, eventually there will be a build up of supply at retail and this should cause prices to move downward, but this is proving to be a slow process. The thinking here is that while GPUs are still flying off shelves in places such as the United States, the middlemen in the graphics card market are unwilling to lower prices in other regions where sales are slower.

There is little incentive to allocate a large portion of GPUs to Europe when they can still sell loads of cards at high prices in North America or other regions. We've seen a few cards start to pile up at Newegg the same way they are in Australia, for example with the RX 6900 XT, but we're still some time off demand being saturated in the US.

Factors at play: bundling and middlemen

The other issue we continue to be told about is the practice of bundling. We've talked about this before in this series but basically if you're unfamiliar, distributors are requiring retailers to purchase massive amounts of unwanted stock to gain access to current generation GPUs. This might involve buying, say, 50 motherboards for every 10 graphics cards.

We've recently been told that bundling has intensified in the past month or two, with AIBs placing a lot of pressure to move products this way, which has caused the upward tick in pricing that we've seen at retail despite cards not selling that well. Through bundling, retailers are forced to increase GPU prices to compensate for the losses made purchasing stock for products that no one wants.

Based on what we've seen over the last few months and what we've heard from those in the industry, it's unlikely this situation at retail will change throughout the rest of 2021. GPU makers and various middlemen are keen on cashing in throughout the upcoming holiday period and seem to be hoping desperate shoppers will give in to their inflated pricing. The fewer people do that, the more likely GPU prices will come down.

What doesn't appear to be much of factor right now are supply constraints causing a high cost of manufacturing and distribution. While it's still true that we're in a supply constrained market, the actual cost to make these GPUs is well below current retail pricing, and other aspects such as increased shipping costs and higher component pricing for memory and PCBs are not to blame here. I don't think it's possible for some of these GPUs to be manufactured at the MSRP, however it also isn't costing OEMs double the MSRP to make these cards, so there is little doubt AIBs are making absolute bank right now.

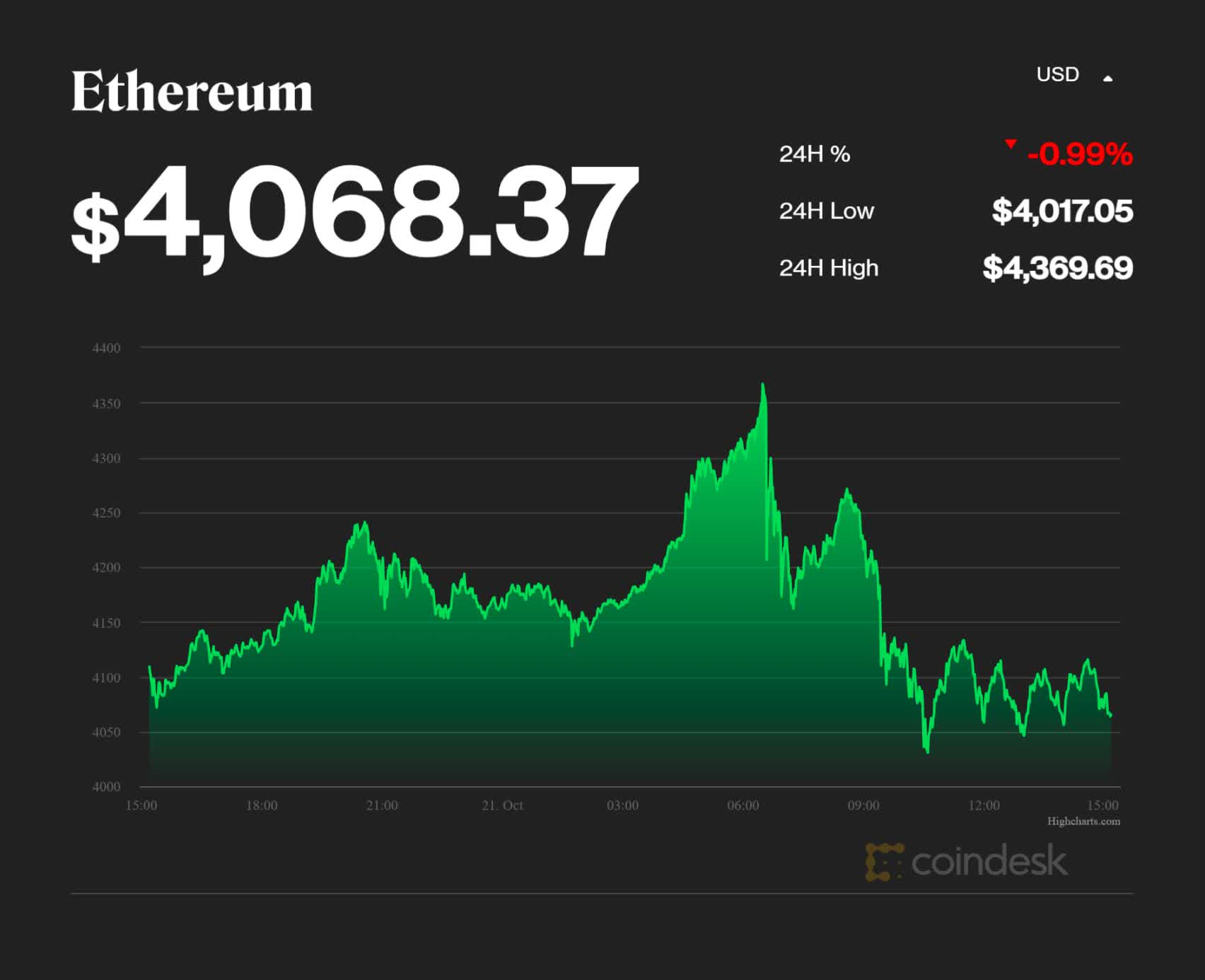

And crypto, of course. Ethereum keeps rising

Cryptocurrency mining remains the number one driver behind high demand and high GPU prices. We've been saying for some time now that while GPUs are highly profitable for mining, they are basically acting like money printers, causing effectively unlimited demand. Increased supply cannot satisfy unlimited demand, and this will continue to be the case until mining is less profitable.

However the ways in which mining affects GPU pricing are complex. Mining difficulty, cryptocurrency value, and future projects all need to be factored in. If mining becomes more difficult, the reward is negatively affected, and mining profitability goes down. If cryptocurrency increases in value, mining is more profitable. But if even on a short-term basis these elements are looking okay for mining, future predictions may cause people to hold off investing in more mining GPUs.

In the past month, the price of the most popular coin for mining, Ethereum, has risen by about 35%, after being relatively flat the month before. During the same period, difficulty has risen by about 7 percent. This has led to an increase in profitability of between 25 and 30 percent (roughly speaking) depending on the exact GPU you have at your disposal. Surely that spells bad news for the pricing of GPUs on the scalper market right? Surely people will want to jump on board the mining train?

Well, that's actually not the case.

GPU Pricing Update

Here we have scalper prices from eBay completed listings as we've been tracking for several months. Despite a significant rise in crypto prices and profitability throughout the month, GPU prices have remained somewhat flat, or in most cases saw small declines. All of Nvidia's GeForce RTX 30 series GPUs dropped in price month on month, the RTX 3070 and RTX 3080 in particular both saw drops of 5% or more, while other GPUs were relatively flat.

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| GeForce RTX 3090 | $1,500 | $2,607 | $2,863 | $2,818 | 88% | -2% |

| GeForce RTX 3080 Ti | $1,200 | $1,815 | $1,880 | $1,851 | 54% | -2% |

| GeForce RTX 3080 | $700 | $1,643 | $1,673 | $1,534 | 119% | -8% |

| GeForce RTX 3070 Ti | $600 | $1,170 | $1,191 | $1,151 | 92% | -3% |

| GeForce RTX 3070 | $500 | $1,228 | $1,180 | $1,121 | 124% | -5% |

| GeForce RTX 3060 Ti | $400 | $952 | $866 | $860 | 115% | -1% |

| GeForce RTX 3060 | $330 | $752 | $708 | $692 | 110% | -2% |

| Average | 100% | -3% |

If we look at pricing history, this means that current prices are among the best we've seen since we began tracking price changes at the beginning of 2021. Despite Ethereum being roughly as valuable now as it was in May, GPU prices are much lower than in May due to lower profitability, and overall pricing is similar to July which was the best month so far. Not the massive downward trend we would like to see, but you have to take small wins these days.

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| Radeon 6900 XT | $1,000 | $1,622 | $1,569 | $1,493 | 49% | -5% |

| Radeon 6800 XT | $650 | $1,268 | $1,411 | $1,388 | 114% | -2% |

| Radeon 6800 | $580 | $1,127 | $1,309 | $1,254 | 116% | -4% |

| Radeon 6700 XT | $480 | $793 | $881 | $872 | 82% | -1% |

| Radeon RX 6600 XT | $380 | $633 | $639 | $621 | 63% | -3% |

| Radeon RX 6600 | $330 | $571 | 73% | |||

| Average | 83% | -3% |

On the AMD side, GPU pricing is also down, following a similar pattern to Nvidia. Of course, prices haven't dropped drastically and most cards only fell in price by a few percent, but considering all the factors at play, flat GPU pricing is about as good as you could hope for. It also bucks a recent trend of AMD GPUs increasing in price. This is the first time since July that we've seen prices fall for most of AMD's GPUs and in general, the level of price inflation is lower for AMD products than Nvidia.

So why haven't GPU prices risen given the increase in mining profitability? For whatever reason, miners aren't adding as many new GPUs into the mining pool now as they were previously.

If we look at the hashrate for the Ethereum network, in September there was an increase of about 80 TH/s, a 13 percent increase. But for this past month, just 40 TH/s were added, or a 6 percent increase. That's one of the lowest increases in many months, and suggests that interest in adding more GPUs for mining has cooled to some degree.

Why is that? China's ban on cryptocurrency transactions could be one factor that has increased uncertainty about investing into mining. When that decision hit the news, Bitcoin price took a dive but then a few weeks later, Bitcoin's price has hit a new all-time high. I'm only a casual observer, so it's hard to say, and on top of this it could just be a short term trend, rather than something more significant. But at least for this month, it appears to be one explanation for why GPU prices haven't risen even though profitability is up – in previous months, GPU pricing was more closely linked to profitability rises and falls. Definitely something to watch in the future.

Used GPU Pricing: No Change

As for the used GPU market, it's pretty uneventful on this end. Across Nvidia's previous generation GPUs in the RTX 20 series, GTX 16 series and GTX 10 series, almost all prices were flat month on month.

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| GeForce RTX 2080 Ti | $1,000 | $1,043 | $1,158 | $1,102 | 10% | -5% |

| GeForce RTX 2080 Super | $700 | $802 | $804 | $786 | 12% | -2% |

| GeForce RTX 2080 | $700 | $703 | $736 | $713 | 2% | -3% |

| GeForce RTX 2070 Super | $500 | $667 | $720 | $722 | 44% | 0% |

| GeForce RTX 2070 | $500 | $614 | $650 | $676 | 35% | 4% |

| GeForce RTX 2060 Super | $400 | $615 | $662 | $657 | 64% | -1% |

| GeForce RTX 2060 | $350 | $482 | $514 | $535 | 53% | 4% |

| Average | 32% | 0% |

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| GeForce GTX 1660 Ti | $280 | $426 | $491 | $476 | 70% | -3% |

| GeForce GTX 1660 Super | $230 | $452 | $494 | $486 | 111% | -2% |

| GeForce GTX 1660 | $220 | $371 | $378 | $387 | 76% | 2% |

| GeForce GTX 1650 Super | $160 | $283 | $302 | $299 | 87% | -1% |

| GeForce GTX 1650 | $150 | $247 | $262 | $266 | 77% | 2% |

| Average | 84% | 0% |

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| GeForce GTX 1080 Ti | $700 | $616 | $676 | $669 | -4% | -1% |

| GeForce GTX 1080 | $600 | $441 | $459 | $464 | -23% | 1% |

| GeForce GTX 1070 Ti | $450 | $406 | $451 | $453 | 1% | 0% |

| GeForce GTX 1070 | $380 | $361 | $373 | $380 | 0 | 2% |

| GeForce GTX 1060 6GB | $250 | $286 | $309 | $297 | 19% | -4% |

| GeForce GTX 1060 3GB | $200 | $223 | $214 | $214 | 7% | 0% |

| Average | 0% | 0% |

Then for AMD GPUs, the RX 5000 series continues to be extremely expensive due to their high performance for GPU mining, and anyone that owns one of these GPUs primarily for gaming should look at offloading it in favor of an upgrade. However, we did see prices for AMD's older GPUs decline month on month, though this could be in response to a larger than expected increase last month. Most GPUs here are also not worth considering.

| MSRP | eBay Average Price August | eBay Average Price September | eBay Average Price October | Current Price Inflation | Price Increase September to October | |

|---|---|---|---|---|---|---|

| Radeon 5700 XT | $400 | $800 | $865 | $943 | 136% | 9% |

| Radeon 5700 | $350 | $730 | $829 | $817 | 134% | -1% |

| Radeon 5600 XT | $280 | $558 | $620 | $617 | 120% | -1% |

| Radeon 5500 XT 8GB | $200 | $344 | $404 | $408 | 104% | 1% |

| Average | 123% | 2% |

Wrap Up

Given increases to crypto mining profitability, I was a little surprised to see GPU prices remain flat month on month. In the months prior that we've been tracking changes, we've seen a close relation between profitability and GPU prices on the scalper market.

In October there seems to be increased hesitancy around buying up more GPUs for mining, leading to a lower than usual increase in the Ethereum network's total hash rate. This in turn likely prevented a spike in GPU prices, which is better than expected news.

Our recommendation remains the same: you should avoid buying a graphics card for gaming at current prices, especially as used GPUs from 4-5 years ago are still selling at their launch MSRP.

There is no GPU that is easy to recommend, and you should only consider buying something if you are desperate for a GPU – for example, if you're building your first PC – or if your current GPU is inadequate for playing today's games. We've recently shown that gaming on High or even Medium settings can still look great and that's something you should definitely consider before paying exorbitant prices – is what you have right now still good enough? We'd guess for a lot of people it might be.

If you definitely want to purchase a GPU right now, the Radeon RX 6600 XT offers the best cost per frame going on current scalper prices, although other GPUs including the 6700 XT, RTX 3060 Ti and RTX 3060 are also worth considering.

At times you can get slightly better prices for LHR versions of Nvidia's cards, so that's the path I would recommend for gamers. High-end GPUs, especially the RTX 3090, are too expensive and you probably shouldn't consider those.

The big question continues to be, of course... when are GPUs going to become more affordable? That's impossible to answer with certainty, and I wouldn't expect much of a downward trend through to the end of this year. However I'm not as doom and gloom about everything as some people are. I've been researching this market for the entire year now and personally I don't think current prices are sustainable.

Short term, it's been all happy times for GPU makers, but longer term, I don't think it's going to work, especially when consoles are priced where they are. But elaborating on that is probably an entire new article in itself, so we'll leave that discussion for another day.