It's time for our monthly graphics card pricing analysis update, yet another one. It'd be great if pricing was normal and we actually didn't have to make these updates, but tracking GPUs is useful in case you are thinking about jumping the gun... and this month we can celebrate a rather unfortunate anniversary.

Updated: See our latest GPU Pricing Update here.

It was just over a year ago that Nvidia launched the first GeForce RTX 30 series graphics cards, the RTX 3080 on September 17 and the RTX 3090 shortly after. Lots of excitement back then with Nvidia promising to sell these GPUs for $700 and $1,500, respectively.

Supply at launch was low, and from there it only got worse with ever increasing demand and other market factors at play. In the space of 12 months it's been nearly impossible to buy one of these otherwise great GPUs off the shelf at the MSRP.

And back then it was shaping up to be such a good time to buy a graphics card. We had just sat through 2-3 years of average GPU launches with Nvidia's RTX 20 series not delivering on the value front and AMD's inability to compete at the high end, so lots of gamers were hoping to jump on a series of GPUs that finally looked good and worthy of an upgrade. Unfortunately, upgrading proved to be difficult, due to extreme pent-up demand from gamers waiting years for an upgrade, additional demand due to the rise of gaming throughout the pandemic, supply issues, and then the crypto boom that began in January, which crippled the market.

But enough about that, let's explore how the market is looking today...

Market Update

Most people at this point know why we're still unable to buy GPUs at the MSRP, but I wanted to focus specifically on a couple of things that we've been tracking over the last few months.

The first of those is AMD's Radeon RX 6600 XT which launched in early August. AMD promised that this would be a $380 GPU – not the best MSRP, but they claimed that plenty of stock would be available at this price level. It was clear shortly after launch that this probably wouldn't be the case for any significant stretch of time, but now that we're over a month post-release, it's become exceptionally clear.

If anything, pricing for the RX 6600 XT has continued to get worse since launch, and it simply is not possible to buy one at a reasonable price in some regions like the United States. In Australia, it was available at the MSRP for about 24 hours, but days later that price had jumped up beyond the MSRP and hasn't returned to decent levels. In fact, right now you'll have to fork out the equivalent of ~50% price inflation for that GPU in most markets. So at this point it's safe to say that AMD's original promise of good availability at the MSRP has proven not to be true for any significant period of time.

Why has the price gone up? Simply put, the original price was well below the current going price for other GPUs in the market. As soon as AIBs and distributors get a whiff of demand and know they can rip off customers, and as soon as AMD stops caring about making the price look good around the launch window, prices began to rise.

Retailers are once again telling us about all the usual issues with distributors raising prices, forcing bundles and so on, just now it's being applied more to the 6600 XT than it was before. Retailers also tell us that since launch, miners are paying increasingly more attention to this card and its value proposition, which has reduced supply in the chain as cards filter out to miners before they hit retail, raising the price in the process.

Yes, you can blame miners again.

With all of that said, the 6600 XT is still cheaper in several regions than Nvidia's closest competitors, the RTX 3060 and RTX 3060 Ti. Despite unattractive retail pricing, availability is actually quite good in many regions, just not in the US.

At PC Case Gear (Australia), right now they have stock of every single current generation GPU, and for most variants you can choose from a significant number of AIB models with only a few out of stock. It's simply the nasty pricing that means these GPUs are not flying off the shelves. Availability has been decent for months now and getting better depending on where you're located. The longer overpriced models sit on shelves, the more pressure there will be to reduce prices.

No GPU for You!

While availability might be decent, gamers are not going to be able to buy affordable GPUs at retail any time soon for two reasons. #1: Nvidia aren't making any significant efforts to bring the lower-cost RTX 3050 to retail. We might see AMD release an RX 6600 non-XT, but that's unlikely to help much either. While the 3050 has been available in laptops for some time now, we haven't heard anything from our contacts to suggest the card is coming to desktop buyers anytime soon. Reason #2: is the big reason, and that's crypto mining.

Of course, it's now clear that GPU pricing is directly linked to mining profitability. It's not related to supply, it's not related to the pandemic, or anything like – GPUs are being priced in line with how much money you can make mining on them. That's the guide that AIBs and distributors are using when they set pricing, and prices clearly change in step with changes to mining profitability.

Crypto fans will probably rush to the comments to point the blame somewhere else, but pricing hasn't been changing in the face of gaming demand – which has remained high for a year now. The main reason why you can't buy a GPU at a decent price is because it's profitable to mine crypto on them, and miners are willing to pay higher prices indefinitely for essentially a money printer. If mining wasn't profitable on modern GPUs, you'd probably have a new GPU in your hands right now at the MSRP, because the record level of supply this generation up to this point is enough to satisfy the gaming demand.

The Crypto Rollercoaster

So, what's been happening over in the land of mining in the last month? Pricing of the most popular coin for mining, Ethereum, has been relatively flat month on month, there was a period a couple of weeks ago where prices were up, that cooled off, and for the past few days there's been a decline. But it's a volatile market as usual, so on the whole it's been flat.

Meanwhile in that period, Ethereum difficulty has risen about 15%, meaning that a decent amount of extra mining hardware is in the pool compared to a month ago. This would have been in response to the rising crypto prices over the last two months, but it has plateaued slightly in the past week. What this means is that miners have been interested in buying GPUs for mining, contributing to higher prices, though the impact is that when difficulty increases, the rewards for mining decrease. So seeing a rise in difficulty is both a good and bad sign for gamers.

Overall, this has led to a drop in mining profitability, right now it's down about 25% month on month, though it does depend on the exact GPU in question. Cards where Ethereum is not the most profitable choice of coin for mining – such as Nvidia's LHR GPUs – have seen more severe declines. However, most of these declines have occurred in the past week after crypto's peak in price, and because there's always a lag before this is reflected in GPU pricing, we're only just starting to see those effects now.

GPU Pricing Update

How has this affected GPU pricing on eBay, which we've been tracking monthly for some time now. Here we have Nvidia's GeForce RTX 30 series looking at completed eBay listings in the past week. Most mid to high-end GPUs haven't changed in price much compared to what we observed a month ago. The RTX 3080 Ti has by 4% on average, while the RTX 3070 decreased by 4%. Then at either end of the scale we have slightly larger changes with the RTX 3090 increasing by 10%, and the RTX 3060 Ti going down in price by 9%, with this GPU still seeming to be in good supply right now.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| GeForce RTX 3090 | $1,500 | $2,599 | $2,607 | $2,863 | 91% | 10% |

| GeForce RTX 3080 Ti | $1,200 | $1,905 | $1,815 | $1,880 | 57% | 4% |

| GeForce RTX 3080 | $700 | $1,623 | $1,643 | $1,673 | 139% | 2% |

| GeForce RTX 3070 Ti | $600 | $1,085 | $1,170 | $1,191 | 99% | 2% |

| GeForce RTX 3070 | $500 | $1,075 | $1,228 | $1,180 | 136% | -4% |

| GeForce RTX 3060 Ti | $400 | $1,012 | $952 | $866 | 117% | -9% |

| GeForce RTX 3060 | $330 | $723 | $752 | $708 | 114% | -6% |

| Average | 107% | 0% |

At the moment, a majority of Nvidia's line-up, especially for their mid-range offerings, are LHR products meaning they have been hit harder by recent reductions to mining profitability. This has been reflected to some extent in pricing, although on the whole Nvidia cards have been relatively flat. I suspect we'll only see price reductions if the crypto market continues to decline for a few more weeks as it has done as of late. It was only a couple of weeks ago that the outlook for miners was much more positive and that helped to keep GPU prices high.

AMD's Radeon RX 6000 series GPUs are not in good supply, and there haven't been many sales of cards like the RX 6800 XT, and especially the RX 6800 in the past week. However, the RX 6700 XT continues to be available, and its price has risen 11% month on month, close to the level of June pricing. With that said, prices are still 25% lower than the peak for this card in March, and there has been no change in pricing for the RX 6600 XT which is still a $640 GPU on the scalper market on average.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| Radeon 6900 XT | $1,000 | $1,460 | $1,622 | $1,569 | 57% | -3% |

| Radeon 6800 XT | $650 | $1,282 | $1,268 | $1,411 | 117% | 11% |

| Radeon 6800 | $580 | $1,087 | $1,127 | $1,309 | 126% | 16% |

| Radeon 6700 XT | $480 | $733 | $793 | $881 | 83% | 11% |

| Radeon RX 6600 XT | $380 | $633 | $639 | 68% | 1% | |

| Average | 90% | 7% |

Based on the volumes we're seeing on eBay, and at retail, it seems that AMD are heavily prioritizing their mid-range GPUs at the expense of high-end products. But without any limitations on mining performance, AMD cards are more susceptible to changes in mining profitability, and that's hurt them this month.

This has affected cost per frame value for buyers looking at a GPU for gaming. In August and in prior months, the RX 6700 XT (and also the 6600 XT) have been the outright leaders in value. However with some Nvidia GPUs seeing price drops, while AMD cards have risen in price, cost per frame is a lot closer in September than it has been. Right now, the RX 6700 XT is only 6% cheaper per frame than the RTX 3060 Ti, compared to 23% cheaper in August.

When you factor in the additional features that Nvidia GPUs offer such as DLSS and superior ray tracing performance, it's no longer the case where AMD has an overall lead in value. With this cost per frame, I'd personally be choosing the RTX 3060 Ti over the RX 6700 XT, while the RTX 3070 Ti is also not looking too bad up against the RX 6800 and 6800 XT. It's only Nvidia's higher end cards that are poor value compared to the rest of the market, but of course we generally still don't recommend paying inflated prices (unless you can make money playing games :).

Used GPU Pricing

On the used market, prices for Nvidia RTX 20 series are up slightly month on month, with most cards in the mid-single digits for increases. The exception is the RTX 2080 Ti, which is priced far too close to the level of a brand new RTX 3070 Ti. That sort of pricing is ridiculous when for $50 more you can get better performance and a brand new product, but of course, mining.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| GeForce RTX 2080 Ti | $1,000 | $952 | $1,043 | $1,158 | 16% | 11% |

| GeForce RTX 2080 Super | $700 | $788 | $802 | $804 | 15% | 0% |

| GeForce RTX 2080 | $700 | $686 | $703 | $736 | 5% | 5% |

| GeForce RTX 2070 Super | $500 | $638 | $667 | $720 | 44% | 8% |

| GeForce RTX 2070 | $500 | $603 | $614 | $650 | 30% | 6% |

| GeForce RTX 2060 Super | $400 | $613 | $615 | $662 | 65% | 8% |

| GeForce RTX 2060 | $350 | $476 | $482 | $514 | 47% | 7% |

| Average | 32% | 6% |

Then we have the GTX 16 series which are still popular in the sub-$500 market. Currently these GPUs are disgustingly overpriced on the used market and products like the 1660 Ti and 1660 Super have gone up quite a bit. You're faced with spending around double these card's MSRP, and that's unlikely to get better soon with Nvidia's reluctance to release an RTX 3050.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| GeForce GTX 1660 Ti | $280 | $428 | $426 | $491 | 75% | 15% |

| GeForce GTX 1660 Super | $230 | $425 | $452 | $494 | 115% | 9% |

| GeForce GTX 1660 | $220 | $359 | $371 | $378 | 72% | 2% |

| GeForce GTX 1650 Super | $160 | $291 | $283 | $302 | 89% | 7% |

| GeForce GTX 1650 | $150 | $248 | $247 | $262 | 74% | 6% |

| Average | 85% | 8% |

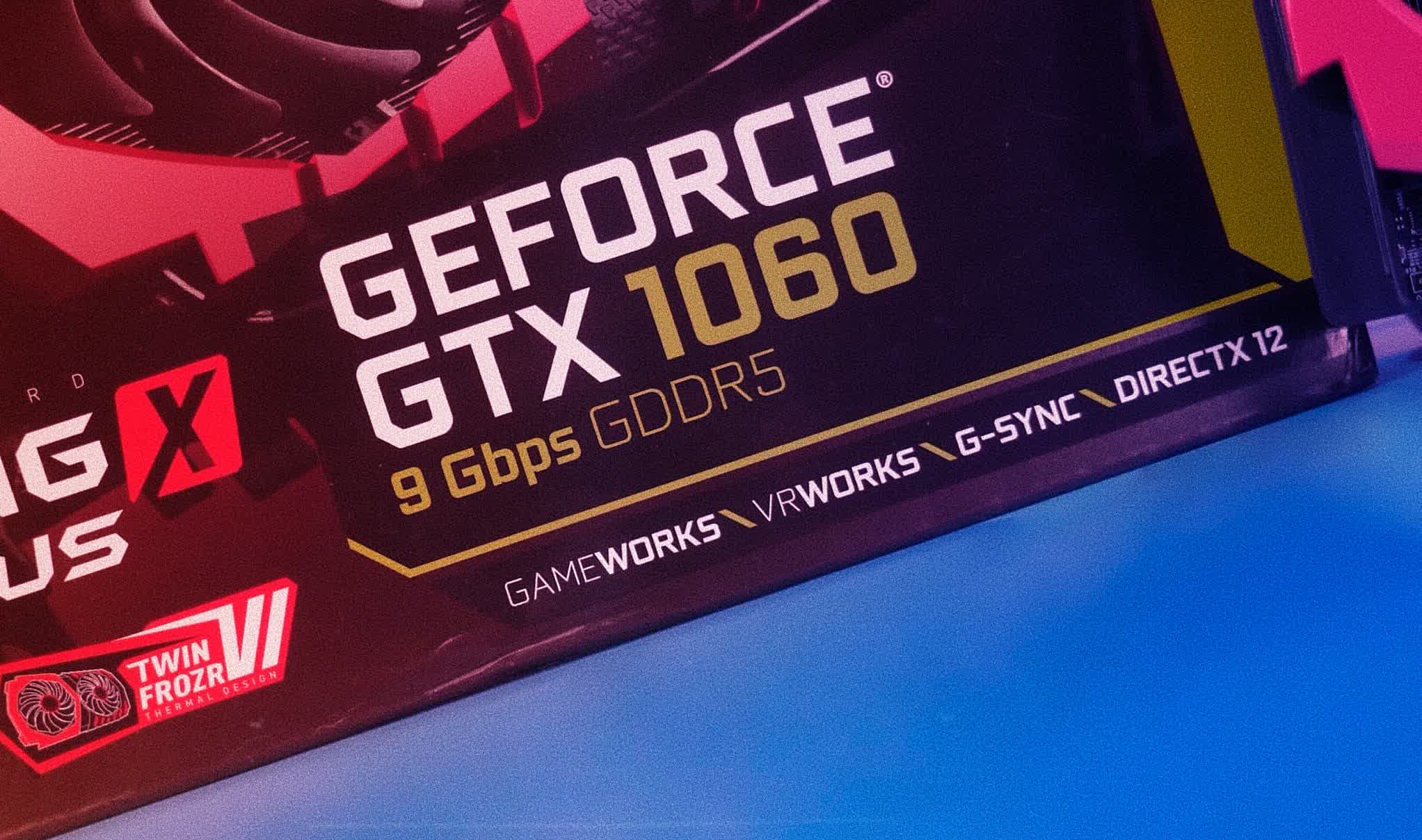

GPUs from Nvidia's GeForce 10 series have risen in price by 5% on average, with some crazy asking prices for cards like the GTX 1080 Ti. On the whole, 10 series cards are selling used for only slightly below their launch price 4-5 years ago, or above that launch price in the case of the GTX 1060 6GB. The 1080 Ti is also poor value compared to brand new RX 6600 XTs for gaming, although the 1080 Ti is much better for mining, so as always that explains a lot of the discrepancy.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| GeForce GTX 1080 Ti | $700 | $550 | $616 | $676 | -3% | 10% |

| GeForce GTX 1080 | $600 | $395 | $441 | $459 | -24% | 4% |

| GeForce GTX 1070 Ti | $450 | $398 | $406 | $451 | 0% | 11% |

| GeForce GTX 1070 | $380 | $337 | $361 | $373 | -2% | 3% |

| GeForce GTX 1060 6GB | $250 | $273 | $286 | $309 | 24% | 8% |

| GeForce GTX 1060 3GB | $200 | $189 | $223 | $214 | 7% | -4% |

| Average | 0% | 5% |

It's no surprise to see that in a month where crypto mining was highly profitable and getting more profitable for a significant chunk, that AMD's RX 5000 series jumped in price by a substantial amount. The RX 5700 XT remains an excellent card for mining, nearly at the level of the RTX 3070 without LHR limits, and better than the RTX 2080 according to Whattomine.

| MSRP | eBay Average Price July | eBay Average Price August | eBay Average Price September | Current Price Inflation | Price Increase Aug to September | |

|---|---|---|---|---|---|---|

| Radeon 5700 XT | $400 | $762 | $800 | $865 | 116% | 8% |

| Radeon 5700 | $350 | $719 | $730 | $829 | 137% | 14% |

| Radeon 5600 XT | $280 | $541 | $558 | $620 | 121% | 11% |

| Radeon 5500 XT 8GB | $200 | $363 | $344 | $404 | 102% | 17% |

| Average | 119% | 13% |

Similar effects with AMD's older GPUs such as Vega 56 and 64, both those GPUs are also good for mining and are sought-after in that market, so most gamers should probably sell their Vega card to a miner and move up to a higher performing product. Cards like Vega 56 fetching over $700 these days is pretty wild, and even cards like the RX 580 8GB are not good value given their much higher price than the GTX 1060 6GB.

Not a Great Outlook

That does it for this month's GPU pricing update. On the whole, prices for graphics cards rose month on month for September, but only slightly, with most cards recording a price hike in the mid single-digit range. Obviously, we'd like to see prices go the other way, so from that perspective it's disappointing, however the crypto market has been going strong until recently, so seeing only a small rise in pricing isn't too bad.

We still don't recommend gamers to pay inflated prices for graphics cards, though we're at a point where cards like the RTX 3080 are now a year old, so naturally some people will be desperate to upgrade and will have been waiting for a year or more. If you do fall into that category, GPUs like the GeForce RTX 3060 Ti, RTX 3060 and RTX 3070 Ti are on the better end of the value scale and Nvidia's LHR program has been effective at reducing prices on what would otherwise be strong performers for mining.

Value has tightened up recently between AMD and Nvidia due to this, which makes cards like the 6700 XT harder to recommend at current scalper prices. However while the 6600 XT has risen in price and continues to rise, it's also worth considering.

The main factor that's going to see graphics card prices drop is a drop in mining profitability. That's been happening across the past week, but will need several more weeks before that's reflected in the GPU market, and of course, profitability might rise next week, who knows. Supply and availability is less of a concern, given GPUs are readily available on store shelves in most regions and have been for some time. It's mostly down to pricing now, which is dictated by mining profitability at this point.

We're also coming up to the holiday period, so it'll be interesting to see how pricing goes during that time and how availability is affected. You'd think that would increase demand, but a lot of people are still waiting for affordable GPUs from the previous holiday period, so it's hard to say. We'll be keeping an eye out and letting you know in these updates throughout the rest of 2021.